Nic Loh

why Bitcoin?

As someone who believes that structural inflation via fiat currency debasement is the root cause for many of society’s ills today, I’m on a journey to advocate for a superior way that Singaporeans can preserve the purchasing power of their labour – the many hours of hard work and effort spent at their jobs. If you’re able to easily comprehend whatever I’ve said so far, and can also also understand what I’m about to say in the subsequent paragraphs, you likely have had the privilege of undergoing a decent number of years of formal education.

However, there are many individuals around the world and even in Singapore who have not been able to enjoy such a privilege. For these individuals, their level of financial literacy may also be extremely basic.

I recall quite a few times in the morning, when I used to prepare to take the train at the MRT station, where I sometimes see queues of people trying to withdraw cash at the ATM. For some of these individuals, their only contact with digital finance could be limited to depositing money into their checking account at islandwide ATMs. They may also be more likely to still use passbooks, deal almost exclusively in cash, and queue up at bank branches. Moreover, the only investments that they may be familiar with, if they even conventionally invest, would be either fixed deposits or buying 916 gold at a pawnshop (not that gold itself is inherently a bad investment, but 916 gold has embedded premiums due to the pretty terrible bid-ask spread, along with the suboptimal level of fungibility).

Although many of these individuals are hardworking, diligent, and frugal, they may not have had the same level of education, or access to the same opportunities as you or me. Modern English-based interfaces involving apps on smartphones can be overwhelming and complicated for a portion of this demographic.

Such a demographic is, I think, most likely to require societal assistance to achieve a shot at having a dignified retirement during the sunset years. However, due to the nature of their financial habits (e.g. keeping an overwhelming majority of their wealth in a checking account) and financial literacy (or lack thereof), it is precisely this demographic that gets punished by fiat currency debasement the hardest.

One of the lessons that many young children are taught early on in life, just as I do recall as a young boy, is the virtue of saving money in a piggy bank for a rainy day, or for long-term goals and plans. Yet in today’s world, savers in cash/fiat are punished. Currency debasement erodes purchasing power of paper money year after year, rewarding short-term consumption and penalising those who plan ahead. Inflation fosters a high time preference, undermining the very virtue of delayed gratification.

For over 5,000 years, gold has served as the archetypal hard money: durable, scarce, and immune to government printing presses. JP Morgan himself made this distinction clear in his 1912 testimony before Congress in the US. When asked about the foundations of banking, he famously declared something along the lines of: “Gold is money; everything else is credit”.

In Morgan’s view, credit depends on trust and the character of the borrower. Credit can default (think of how some reckless individuals can drown in credit card debt and go bankrupt, or how certain countries default on their issued sovereign debt).

Gold, on the other hand, requires no trust and carries zero counterparty risk. If I have 100k in Malaysian ringgit stored in a safe, and for whatever reason the entire Malaysian country is vaporised in a nuclear attack, my Malaysian fiat would be worthless.

This can’t happen with gold. Gold has value regardless of which country goes poof. Gold has intrinsic value that is backed by the hard work and effort it took for people to search for the rare gold, mine it, and refine it. That is why hard money, whether gold in the past or Bitcoin today, acts as a vital check on fiscal irresponsibility. Governments can dilute fiat/paper money at will via simple money-printing and capture seignorage, but they cannot conjure gold or Bitcoin out of thin air.

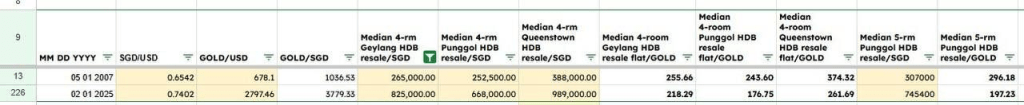

In fact (and this may surprise many Singaporean readers), when priced in troy ounces of gold, HDB flats in Singapore have even gotten more affordable over time (sources: publicly available data on HDB’s website, historical gold prices, historical exchange rates).

However, I posit that there is a harder (better) form of money than gold. In this digital age, we have access to digital gold which overcomes many of the disadvantages associated with physical bullion. That digital gold is Bitcoin.

As digital gold, Bitcoin is a commodity that checks many of the boxes for the desired characteristics of ideal money: censorship-resistance, divisibility, durability, fungibility, portability, scarcity. With more people in the world increasingly recognising Bitcoin’s role as the premier store of value today, Bitcoin is an asset that hedges against the perpetual debasement of fiat currencies worldwide. It demonetises areas where capital is misallocated, and siphons the monetary premium of real estate, conventional debt instruments, and stocks.

For the uninitiated, I would recommend reading an excellent yet relatively digestable four-part primer to Bitcoin that was first written and published in 2018, available here. For readers able to commit reading a full-length book, I can also wholeheartedly recommend The Bitcoin Standard, by Saifedean Ammous, a book that I read cover-to-cover during a holiday to Vietnam in late 2024. Another good book I’d recommend is Broken Money, by Lyn Alden. Individuals who are more keen on a video format can consider watching this excellent 40-minute video. Last but not least, arguably the most well-created, accessible, and non-technical explanation of how Bitcoin works can be found in this YouTube video entitled ”But how does bitcoin actually work?” by the famous YouTube channel ‘3Blue1Brown’. If you’ve made it this far, I thank you for taking a portion of your time for reading what I’ve written. I hope you’ve found it useful to the extent that it has piqued your curiosity in digital gold.